On June 2, China Jushi took the lead in releasing the price reset letter, announcing that wind power yarn and short cut yarn price reset of 10%, which formally opened the prelude to the price reset of wind power yarn!

When people are still wondering whether other manufacturers will follow the price resumption, June 3, June 4, Taishan Fiberglass, international compound price adjustment letter came one after another, the official announcement: wind power yarn, short cut yarn price resumption of 10%!

In fact, not only has the price of fiberglass increased significantly, but the resin industry is no exception. According to the resin price index on June 3 released on the official account of “Fulcrum Smart Service”, the price of raw material market soared. This week, the unsaturated resin market continued to increase by 300 yuan, including 500 yuan for molding resin.

Where does the courage and confidence of manufacturers come from when product prices rise?

Firstly, as a high-end product in the field of fiberglass, wind power yarn has the characteristics of high industry concentration, high proportion of long-term cooperative customers, and high brand bargaining power.

We all know that wind turbine blades are mainly composed of glass fiber composite materials. Currently, glass fiber remains the core and key material for low-cost large MW blades. In the wind power field, especially with the increasing demand for large MW blades, it will not only significantly increase the demand for glass fiber, but also drive the demand for some carbon fiber products (mainly carbon beams). Although carbon fiber has significant advantages in strength and lightweight compared to glass fiber, it has obvious disadvantages from the perspective of material cost-effectiveness and insulation performance. The possibility of achieving large-scale production and continuous cost reduction on the same level as the glass fiber industry for carbon fiber is relatively low in the short term. In recent years, glass fiber has been continuously iterated and upgraded, with improved product performance and cost-effectiveness, and its applications becoming increasingly widespread.

As wind power enters the era of parity, the growth potential of the industry is further strengthened, and national policies such as vigorously developing the marine economy and the “Villages Wind Control Action” have led to a decrease in costs. In the current situation, there is still significant room for growth in the medium and long-term installed capacity demand. We know that the most effective way to reduce the cost of electricity is to continuously expand the capacity of single machines. Therefore, the “large-scale, lightweight, and low-cost” development of wind power blades is an inevitable trend. High performance fiberglass wind power yarn is still the preferred choice in the wind power field. Therefore, strong demand is the biggest confidence for the re pricing of fiberglass wind power yarn.

In terms of cost, it cannot be ignored either. The three major fiberglass manufacturers have mentioned in their reply letters that the costs of raw materials, labor, and other costs have increased, including investment in technology and research and development costs.

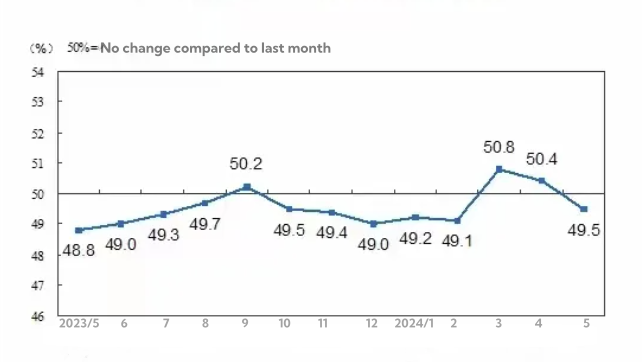

From the above data, it can be seen that in the past 12 months, only three months have the PMI index slightly exceeded the boom bust equilibrium point of 50, while the rest of the months have been in a downturn range.

From the above data, it can be seen that in the past 12 months, only three months have the PMI index slightly exceeded the boom bust equilibrium point of 50, while the rest of the months have been in a downturn range.

If the PMI index represents economic activity, prosperity and recession, expansion and contraction, then looking back at our year’s journey, in fact, our economy is in a sustained contraction and recession.

The biggest influencing factors are still real estate and infrastructure construction. The former depends on the money bags of the people, while the latter depends on the money bags of the local government.

From January to April, the newly constructed residential area was 1700.6 million square meters, a year-on-year decrease of 25.6%.

That is to say, by April 2026, the available sales area of new houses will decrease by 25.6% compared to January April 2025. In other words, the demand for quartz in the real estate market for new houses from January to April 2026 will continue to decrease by 25.6% year-on-year.

Post time: Jun-07-2024